Grading Biden’s Signature Law

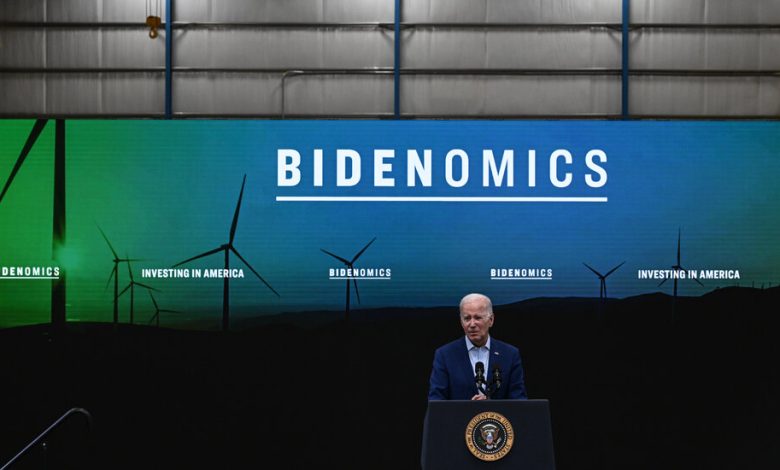

The Inflation Reduction Act is popular with business, and that’s adding to its cost.Credit…Kenny Holston/The New York Times

The costs, and the benefits, of the I.R.A.

In the past 24 hours, President Biden has taken questions (and heat) on his age, memory and mental fitness. But the one economic issue that is most likely to generate scrutiny from the business community and beyond over the next several months is the biggest bill he has passed, the Inflation Reduction Act, which he hailed at his news conference last night.

Big questions still hang over the law, which many Americans appear not to know exists. How much will it add to the federal deficit? And can the law survive a potential Trump second term?

The I.R.A. is expected to cost more than $800 billion through 2033, the Congressional Budget Office said, up from the $391 billion price tag assessed when it was passed in 2022.

One reason: There’s huge demand for the credits and subsidies created by the law for building solar, hydrogen and nuclear energy projects, as well as discounts for buying electric vehicles. (An analysis by Goldman Sachs last fall showed that the law led to about $282 billion in investment and roughly 175,000 jobs in its first year.)

The green transition won’t come cheap. The I.R.A., which aims for steep emissions cuts, is expected to add $250 billion more to the deficit than initially forecast, according to the C.B.O., despite cost-saving promises by the White House.

That said, the math isn’t set in stone. The Treasury Department forecast this week that additional tax-collection resources provided by the I.R.A. would help the I.R.S. gather up to $851 billion more in tax revenue over the next decade. That raises the question of whether this is actually a deficit-paring law.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in.

Want all of The Times? Subscribe.