5 Takeaways From the Spring Art Auctions

When Christie’s executives decided on the evening of the auction house’s contemporary art sales to withdraw its most expensive offering of the week, a squiggly-wiggly painting by the artist Brice Marden estimated to sell for $30 million to $50 million, it was evidence of apprehension in the market.

“The choice to withdraw the Marden was ours,” Alex Rotter, a Christie’s specialist, told reporters last Tuesday night. “It wasn’t Brice’s evening and we’re not willing to jeopardize the market of an artist like that.”

In other words, just two days into a week of marquee spring sales that ended Saturday, there was already a bad vibe.

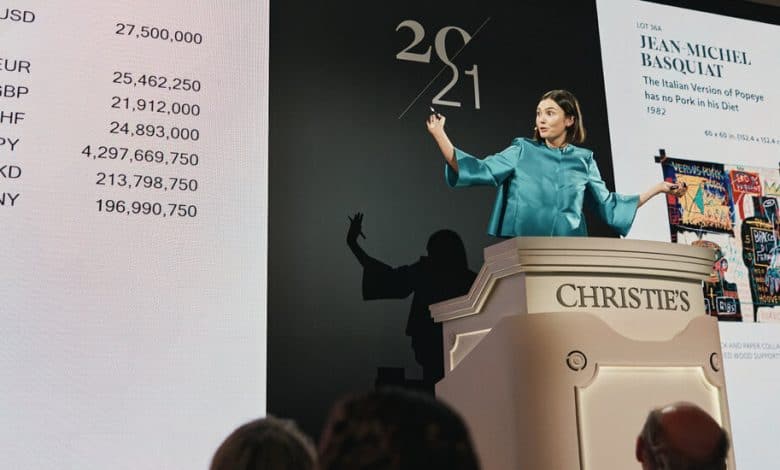

The art market’s greatest weaknesses are uncertainty and doubt — emotions that have a greater effect on the industry because it revolves around a relatively small number of ultrawealthy buyers and sellers. There was plenty of angst last week after a “technology security issue” took down Christie’s official website, which remained down for the entire week. Cybersecurity experts said it was most likely the result of a ransomware attack, with still-unclear consequences for the private data of the auction house’s clients.

Without the eye-popping prices and masterpiece-filled estates of dead moguls like David Rockefeller and Paul G. Allen that have defined auctions of recent years, the spring sales at Christie’s, Sotheby’s and Phillips delivered $1.4 billion, on estimates ranging from $1.3 billion to $1.8 billion. That’s a 22 percent decrease from total earnings of $1.8 billion in 2023 — a respectable finish, according to market experts, given the dearth of major estates and the financial challenges of this season.

But the results will do little to persuade collectors to part voluntarily with top material during the next major auction season in November, when the outlook will be made even more uncertain by the U.S. presidential election.