European Central Bank Cuts Interest Rates for First Time Since 2019

The European Central Bank lowered interest rates on Thursday for the first time in nearly five years, signaling the end of its aggressive policy to stamp out a surge in inflation.

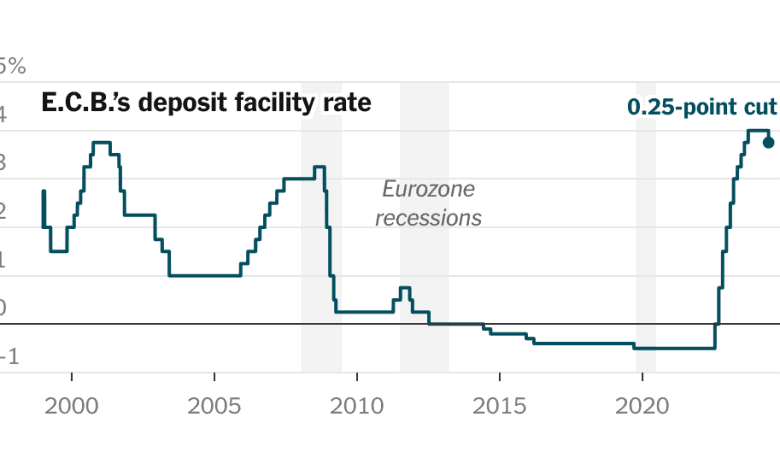

As inflation returned within sight of the bank’s 2 percent target, officials cut their three key interest rates, which apply across all 20 countries that use the euro. The benchmark deposit rate was lowered to 3.75 percent from 4 percent, the highest in the bank’s 26-year history and where the rate had been set since September.

“The inflation outlook has improved markedly,” policymakers said in a statement on Thursday. “It is now appropriate to moderate the degree of monetary policy restriction.”

There is growing evidence around the world that policymakers believe high interest rates have been effective at restraining economies to slow inflation. Now, they are lowering rates, which could provide some relief to businesses and households by making it cheaper to obtain loans.

“Monetary policy has kept financing conditions restrictive,” policymakers said. “By dampening demand and keeping inflation expectations well anchored, this has made a major contribution to bringing inflation back down.”

On Wednesday, the Bank of Canada became the first Group of 7 central bank to cut rates. Central banks in Switzerland and Sweden also cut rates recently.