E.V. Sales Are Slowing. Tesla’s Are Slumping.

As sales of Teslas drop and demand for electric vehicles cools — even as more models enter the market — an increasing number of automakers are competing for a slice of a shrinking pie.

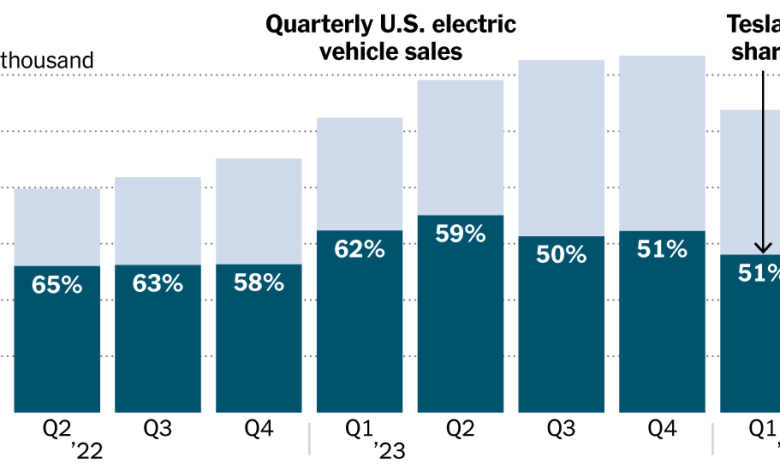

Nearly 269,000 electric vehicles were sold in the United States in the first three months of this year, according to Kelley Blue Book. That was a 2.6 percent increase from the same period last year, but a 7.3 decrease from the final quarter of 2023. And amid the quarter-to-quarter slowdown in the industry, Tesla’s market share has fallen from 62 percent at the start of 2023 to 51 percent now.

Elon Musk told employees on Monday that Tesla would cut 10 percent of its work force. Investors, in turn, have been spooked: Tesla’s stock price has dropped over 30 percent this year, erasing billions of dollars in market capitalization.

Tesla sales fell more than 13 percent compared with the first quarter last year, while most of its emerging competitors saw double or even triple-digit growth. Legacy car brands like Hyundai, Mercedes and BMW have also increased their E.V. sales and chipped away at Tesla’s market share.

Ford’s E.V. market share jumped to 7.4 percent from 4.2 percent in the past year, making it the second-largest electric vehicle brand in the United States. Ford, however, announced this month that it was slowing down its E.V. production plans in response to slowing demand.

The increased competition comes as President Biden has sought to promote the transition to E.V.s. Mr. Biden has set the ambitious goal of having E.V.s make up half of all cars sold in the country by 2030. Currently, they make up less than 20 percent of new vehicle registrations.