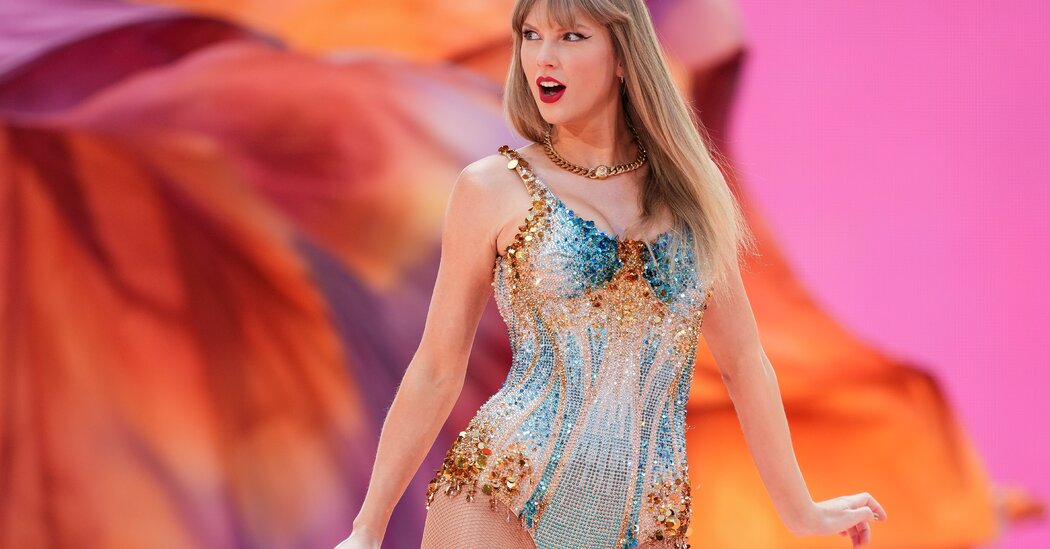

U.K. Inflation Steady as Economists Puzzle Over ‘Taylor Swift Effects’

Inflation in Britain held steady in June as the Bank of England inches toward its first interest rate cut in years and economists pondered whether a global pop star helped keep services prices higher.

Consumer prices rose 2 percent from a year earlier, the Office for National Statistics said Wednesday, the same rate as in May, and in line with the central bank’s target. Inflation was pulled down by cheaper clothing but offset by a jump in the price of hotel rooms. Food inflation also slowed, with prices rising just 1.5 percent compared with a year ago.

The inflation report and data on wage growth expected on Thursday are being closely watched by investors, who had been betting on a 50 percent chance the central bank will cut rates at its meeting in early August.

But the June inflation data came in slightly higher than expected. Core inflation, which excludes energy and food prices, was expected to dip but remained at 3.5 percent in June. Traders reduced their bets on an August rate cut, giving it about a 35 percent chance.

Inflation in the services sector, which includes categories like hospitality, held steady at 5.7 percent in June, defying economists’ expectations for a fall. Wage costs make up a significant proportion of services inflation, meaning once those costs start to rise, it can be hard to bring prices down.

The increase in hotel prices in June — up almost 9 percent from the previous month — coincided with Taylor Swift’s Eras Tour landing in Britain. The tour has become something of an economic phenomenon, with potentially inflationary consequences. Ms. Swift performed 10 shows in Britain in June, and is returning in August.