Why Are C.E.O.s Suddenly Obsessed With ‘Elasticity?’

From McDonald’s to Coca-Cola to Hershey, corporate executives lately are preoccupied with inflation and what it means to the bottom line. And on calls in the past few weeks with investors about their financial results, conversations have dwelled on a peculiar way of talking about it: “elasticity.”

They were not referring to waistlines during the pandemic, but an economic concept that says a lot about the precarious state of the American consumer. Despite the fastest inflation in decades, consumer spending has held up relatively well so far. But this may not last, and that’s where elasticity comes in.

The price elasticity of demand, to use its full name, measures how sensitive buyers are to price changes. Typically, when the price of, say, a can of Coke goes up, people buy fewer cans or switch to a cheaper brand. If a small rise in price leads to a big fall in demand, the item is said to be more elastic. That makes chief executives tremble. But if a big rise in price has little effect on demand, the product is considered inelastic — and a good thing for companies’ profit margins because they can raise prices without risking a drop in sales.

Keurig Dr Pepper

Marriott

Callaway Golf

Many other companies have also stressed that their products, from Starbucks iced coffee to Planet Fitness gym memberships, have remained in demand despite high inflation. People seem particularly willing to pay for experiences, like travel and sports events, even at higher prices, after being deprived of them under pandemic restrictions. Disney reported a 50 percent jump in quarterly profit as business at its theme parks rebounded strongly.

As companies raise prices to cover their own rising costs, they are making bets on elasticity. And when they talk about it, they are engaging in the time-honored tradition of describing their actions in a way that Wall Street analysts readily understand but the general public often does not. (See also: “taking price” and “price-mix improvements” as euphemisms for “We raised prices.”)

When companies raise prices, they make assumptions about the strength of their brands and how inflation affects their typical customers — earnings at the mass-market retailer Target have plunged because its shoppers have been buying less clothing and electronics, while the luxury house Hermès, maker of the pricey Birkin bag, recently reported its biggest profit margin ever.

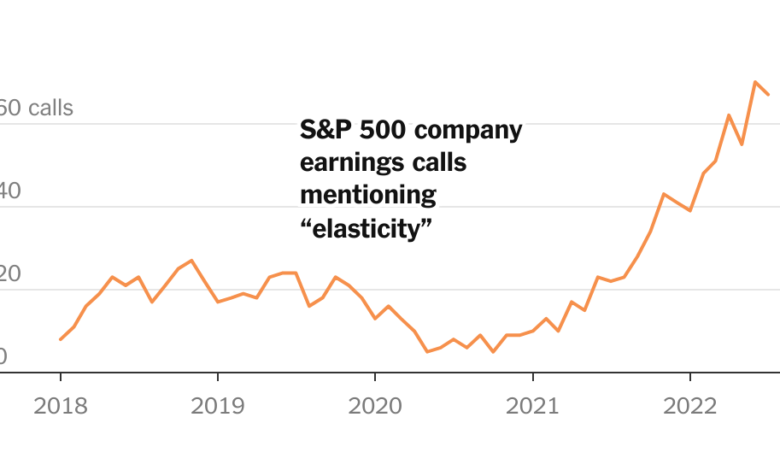

Fittingly, the number of mentions of elasticity on the earnings calls mimics the inflation rate: bumping along at a relatively low level of about 2 percent for years before soaring to new heights in recent months, above 9 percent in June.

Several companies say they have already noticed higher prices hurting demand, at least for some of their products. That has been true for Kellogg, which saw cereal sales in Europe slow; Tyson Foods, the largest U.S. meat processor by sales, which said customers were shifting away from more expensive chicken and meat offerings in favor of cheaper cuts; and Ralph Lauren, which said it had seen some of its “value-oriented” customers pulling back.

Walmart

Southwest Airlines

Procter & Gamble

And a few companies have raised alarms about inflation already leading to broad-based weakness in demand.

HanesBrands

Crocs

Sweetgreen

The growing chatter about elasticity suggests that the point at which higher prices could force broader consumer cutbacks is approaching.

“In the first half of the year, we saw minimal price elasticity across our portfolio,” Michele Buck, the chief executive of Hershey, told investors. “We continue to expect more elasticity in the second half of the year than what we have experienced year to date.”

Kimberly Greenberger, an analyst at Morgan Stanley, said in an interview that during pandemic restrictions, consumers altered their buying patterns, which might have made them better equipped to do so again if things become too expensive.

“They have broken habits over the last couple of years that were long entrenched,” she said, “and they are making real-time adjustments this year to the inflationary pressures.”