How Long Does It Take to Save Up for a Down Payment?

With down payments ticking up in tandem with home prices and interest rates, how long does it take to save up enough to put down on a home? According to a recent study by Zillow, a home buyer making the national median income of $82,156 would have to save for 12 years, assuming a 10 percent savings rate plus interest, in order to accumulate the $127,743 down payment needed to afford a mortgage on a typical U.S. home costing $360,681.

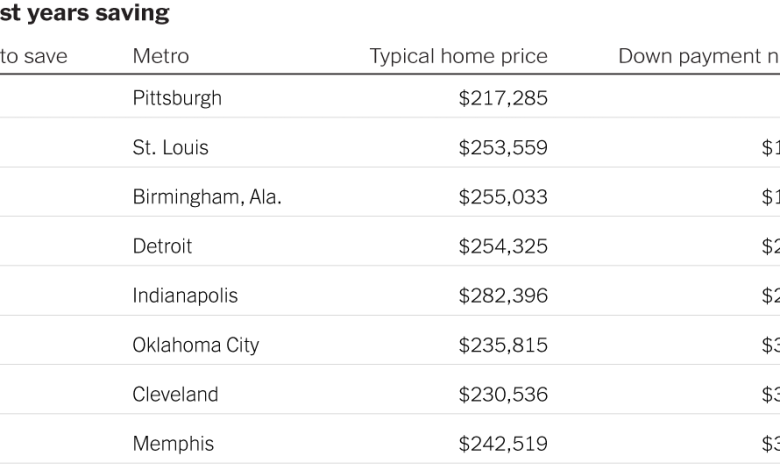

For each of the largest 50 metro areas in the United States, Zillow calculated the typical down payment and savings period, based on the value of a typical home and the local median income. In the study, a home was considered affordable, after the down payment, if the mortgage payment, including principal, interest, insurance and maintenance, equaled no more than 30 percent of income. Typical home values were an average of the middle third of homes in a given area according to Zillow’s Zestimates; other data came from Freddie Mac, the Census Bureau and the Bureau of Labor Statistics.

In Pittsburgh, the most affordable metro, it would take no time at all to save up a down payment. That’s because the local median income of $77,550 would qualify a buyer for a mortgage equal to the full cost of the typical home there, $217,285. St. Louis and Birmingham, Ala., weren’t too far behind, requiring down payments of less than $20,000 and one to two years of saving.

But in Los Angeles, a typical home, valued at nearly $1 million, would require a down payment of $780,203 and just over 36 years of saving. The four longest saving periods were all in California, with periods over 30 years in Los Angeles, San Jose, San Diego and San Francisco.

So how do people manage to buy? Generational wealth helps: The study found that 43 percent of buyers last year got help with their down payment from family or friends.

For weekly email updates on residential real estate news, sign up here.